guidelines on real property gains tax

In 2020 the provincial education tax rate was set at 0255 of total residentialfarmland equalized assessment value and 0375 of total equalized assessment value for non-residential. If youre buying selling renting out investing renovating or developing property or land you need to consider your tax obligations including income tax capital gains tax CGT and goods and services tax GST.

Capital Gains Tax On Real Estate Kiplinger

Extensions to the 2-year ownership period.

. How CGT applies to inherited assets. Co-ownership and right of survivorship. I live in a Low-Income Housing Tax Credit property and have been informed that my rent is increasing based on the.

The frequently asked questions FAQs below expand upon the examples provided in Notice 2014. Gross income includes gains but not losses reported on Form 8949 or Schedule D. Joint Tenancies 27.

938 PDF explaining that virtual currency is treated as property for Federal income tax purposes and providing examples of how longstanding tax principles applicable to transactions involving property apply to virtual currency. We welcome your comments about this publication and your suggestions for future editions. These gains specify different and sometimes higher tax rates discussed below.

Imposition Of Penalties And Increases Of Tax. Inherited property and CGT. 7 tax benefits of owning rental property.

How real estate ads are trying to trick you headline 5 things no one tells you about buying an investment property. Why dont the income limits for my area reflect recent gains or losses. Assessment Of Real Property Gain Tax.

Co-ownership and right of survivorship. Most of the changes in the new law took effect in 2018 and will impact tax returns filed in 2019. And gains beneficial use of the property held in trust.

How CGT applies to inherited assets. How changing residency affects CGT. The tax is calculated by multiplying the current year property-value with the total tax rate which mainly consists of a municipal tax that depends on the municipality of the property and an education tax that is the same throughout OntarioThe tax is used to pay for city services such as police the fire department and public transit as well.

It is then up to the municipalities to determine how they will fund the education tax and to set their own education tax rates for different property types. Get your paper done in 6 hours or less. Here are five ways you can do this legally.

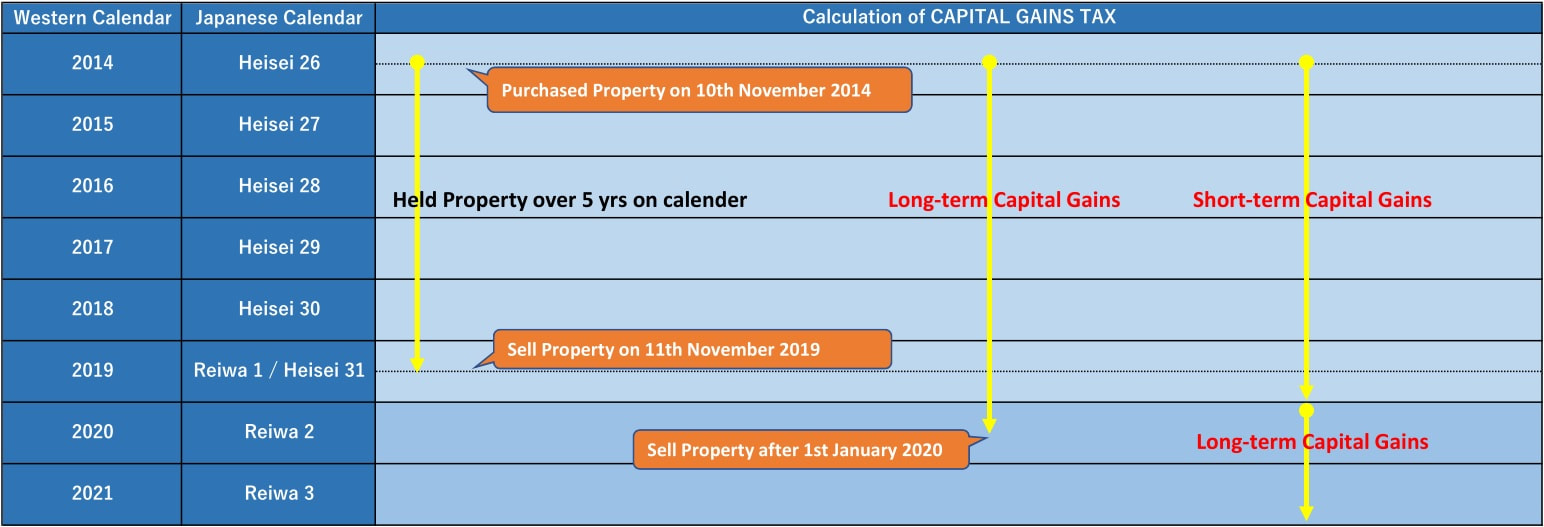

Gains that may be deferred are called eligible gains They include both capital gains and qualified 1231 gains but only gains that would be recognized for federal income tax purposes before January 1 2027 and that are not from a transaction with a related person. They have to undergo a lengthy process to claim refund. Since we are talking about the sale of real property here we need to know the definition of real property.

Capital gains tax for property sold by NRI. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Calculating a partial exemption for inherited property.

In case the transaction qualifies to attract long-term capital gains LTCG a tax rate of 20 will be applicable on the sale. Do note here that the NRI seller will have to pay 21 tax on the sale amount and not the profit money as LTCG. How changing residency affects CGT.

Cost base of inherited assets. Redemptions of Tax-Reverted Properties 24. Inherited property and CGT.

7-2003 states that Real property shall have the same meaning attributed to that term under Article 415 of Republic Act No. To help investors avoid paying more taxes than required lets take a look at 7 tax benefits and deductions for rental property that every real estate investor should know. Those with incomes above 501601 will find themselves getting hit with a 20 long-term capital gains rate.

There are separate poverty guidelines for Alaska and Hawaii. NW IR-6526 Washington DC 20224. Message via chat and well get onto it.

If you lived in the residence for at least two out of the last five years the property is considered a primary residence and you may qualify for a 250000 deduction 500000 for married couples from any gain you had on the sale of the property. FS-2019-3 March 2019 The Tax Cuts and Jobs Act TCJA included a few dozen tax law changes that affect businesses. Along with our writing editing and proofreading skills we want to make sure you get real bang for your buck which is why we provide all these extra features.

386 otherwise known as the Civil Code of the Philippines. If you sold a UK residential property on or after 6 April 2020 and you have tax on gains to pay you can report and pay using a Capital Gains Tax on UK property account. Nonresident aliens are generally not subject to tax on US.

Property such as real estate and collectibles including art and antiques fall under special capital gains rules. Gross income from a business means for example the amount on Schedule C line 7 or Schedule F line 9. Inherited assets and capital gains tax.

Real estate whether residential or commercial and any business interests also must be valued. Foreign residents and capital gains tax. Foreign residents and capital gains tax.

Cancellation Of Disposal Sales Transaction. This fact sheet summarizes some of the changes for businesses and gives resources to help business owners find more details. Source capital gains.

Section 2c of RR No. If the injured spouses residence was in a community property state at any time during the tax year special rules may apply. By learning the tax exemptions and discounts youre eligible for you could lower your capital gains tax from investment property youve decided to sell.

The remaining 48 states and the District of Columbia use the same poverty guidelines. Calculating a partial exemption for inherited property. Calculating capital gains tax on your foreign rental property.

Operating expenses for managing and. Operating expenses are deductible. Cost base of inherited assets.

Court Orders 26. Preform studies reports analysis memoranda and other similar documents. Or both conveys residential real property to the trust and the sole present beneficiary or beneficiaries are the settlors or settlors spouses mother father brother.

Extensions to the 2-year ownership period. Your tax rate is 0 on long-term capital gains if youre a single filer earning less. 46112 Foreign Investment in Real Property Tax Act 461121 Program Scope and Objectives 4611211 Background 4611212 Skip to main content.

Inherited assets and capital gains tax. When you sell a property that you used for affordable rental housing you can reduce your capital gains tax CGT by 10 more than the 50 discount. Before you know it tax season will be here.

Depending on the nature and value of the property this may be a routine activity but you may need the services of a specialist appraiser if for example the decedent had rare or unusual items or was a serious collector. In 2014 the IRS issued Notice 2014-21 2014-16 IRB. Pegangan Dan Remitan Wang Oleh Pemeroleh Available in Malay Language Only Shares In Real Property Company RPC Procedures For Submission Of Real Porperty Gains Tax Form.

Disposing of an asset.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Can You Avoid Capital Gains By Buying Another Home Smartasset

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Capital Gains Tax In The United States Wikipedia

Capital Gains Depreciation Recapture 1031 Exchange Rules 2021 Update

How To Calculate Capital Gains Tax H R Block

Tax Avoidance Methods Nyc Real Estate Donald Trump

/153221908-5bfc2b8c4cedfd0026c118f2.jpg)

Do You Have To Pay Capital Gains Tax On A Home Sale

Tax On Farm Estates And Inherited Gains Farmdoc Daily

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

How To Avoid Capital Gains Tax On Real Estate Quicken Loans

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Capital Gain Tax Arrows International Realty

Selling Stock How Capital Gains Are Taxed The Motley Fool

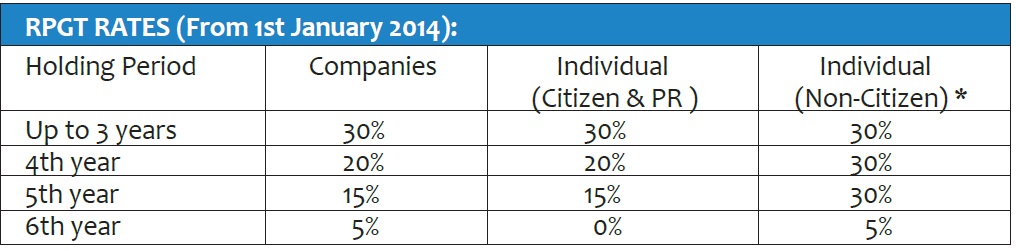

Property Taxes Fees And Hidden Costs In Malaysia Expatgo

0 Response to "guidelines on real property gains tax"

Post a Comment